A long-term business loan could allow you to invest in your business and spread the expenses out over time. Let’s look at some of the things you need to be aware of if you plan to take out a business loan long-term.

What Are Long-Term Business Loans?

Most of the time, a long-term business loan is financing with a repayment term that can last from three to 10 years. Some long-term business loans, such as those offered by the Small Business Administration, can have terms up to 25 years.

In contrast, short-term loans typically have to be repaid within three to 24 months. Most span 12 months or less.

Medium-term loans fall right in between: their terms typically last two to five years.

Key Features of Long-Term Business Loans

Here’s a deeper dive into long-term business loans.

Loan Term Length

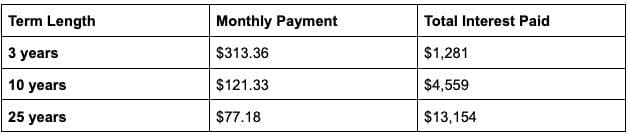

The longer the term, the lower the monthly payment. However, the longer you take to repay the loan, the more interest you’ll pay overall. For example, here’s what a $10,000 loan would look like, with 8% interest and a 3, 10, or 25 year term:

While a lower monthly payment and longer repayment period may make it easier to cover your expenses in the short term, consider the overall impact of the term length.

A longer loan term gets you more cash flow now, which may help you grow your business. But it’ll cost you more later. A shorter loan term could have the lowest ultimate cost, but you’ll have to make a larger monthly payment.

Interest Rates

Unlike consumer loans, long-term business loans tend to have lower interest rates than their short-term counterparts.

Interest can be fixed or variable. A fixed interest rate means it will stay the same throughout the lifetime of the loan. If it's variable, the rate could change based on market conditions.

Having a fixed interest rate makes it easy for you to plan your budget for repaying the loan.

Having a variable interest rate could be a benefit or a risk. If rates drop, your loan could get cheaper. If rates go up, you’ll have to pay more. When rates are rising, many borrowers look into refinancing their variable-rate debt into a fixed-rate loan.

Repayment Structure

Repayment structures for business loans come in different forms. Here are a few of the most common.

Fully amortized. You’ll make the same payment every month. The amount is calculated to fully pay off your loan by the end of your repayment period.

Interest-only. Some loans allow you to pay only the interest at the beginning of the repayment period. If you do this, the amount you owe won’t go down. The advantage is that it’s the lowest possible payment, which could be helpful if you have other financial demands to consider. Eventually, you’ll be required to make a regular principal and interest payment.

Balloon payment. You make smaller, more affordable payments for most of the repayment period, and then one great big payment at the end. This system is a way to preserve cash flow. You’ll need to think about how you’ll afford the balloon payment.

Loan Amounts

Long-term loans can be for almost any amount up to several million dollars. Smaller loans tend to have shorter repayment periods, so for a long-term loan, we’re probably talking about loans of at least $10,000.

Advantages of Long-Term Business Loans

So why consider taking out a long-term business loan? Some business expenses require more substantial funding, such as purchasing real estate or constructing a building. You could accomplish these goals with a long-term loan.

And because long-term loans tend to have lower interest rates than short-term loans, you could look for affordable financing that you can plan your budget around.

Having more time to repay your loan means your monthly payments will be lower, which may help if your budget is tight.

Financing with a longer repayment period allows you to invest in the growth and development of your business without worrying about repaying the loan within a matter of months.

Challenges and Considerations

While interest rates may be lower with a long-term business loan, remember that interest does add up over time. The longer you take to pay off your loan, the more you'll pay in total interest.

Also, committing to long-term debt is significant. If your business were to shut down, what would happen to that loan? More than likely, you would still be responsible for paying it off.

Taking out a loan may impact your personal and business credit, and could affect your ability to take out financing in the future.

Where to Find Long-Term Business Loans

You can find long-term business loans in several places, including:

- Banks

- Credit unions

- Small Business Administration

- Online-only lenders

- Business Development Companies (BDCs)

- Community Development Financial Institutions (CDFIs)

How to Choose the Right Long-Term Loan

Sold on taking out a long-term loan? Let's look at tips for how to find the right one for your business needs.

1. Determine What Your Business Needs

Start by considering the purpose of the financing and the amount you need. Is a long-term loan aligned with your business goals? If so, proceed. If you need to borrow $10,000 or less, you may be better off with a short-term loan.

2. Compare Loan Options

You're not simply looking for the lowest interest rate here. You also want to consider a given lender's reputation for customer service. Is the company easy to reach? Are online reviews positive? Do you have a prior relationship with the lender?

3. Get to Know Terms and Conditions

If this is your first time taking out business financing, familiarize yourself with these key terms:

Secured vs. Unsecured Loans. Secured loans require collateral, or assets with value that could be taken and sold if you're unable to pay back the loan. Interest rates may be lower for secured loans than for unsecured loans. Unsecured loans don’t require collateral. They represent more financial risk for the lender and that’s why they tend to cost more.

Fees. Here are a few examples to keep an eye out for:

- Origination fees to process the loan

- Prepayment penalties if you pay off the loan early

- Annual fee

- Late payment fees if you're late making your monthly payment

- Application fee

- Administrative fees

- Unused line fee (for a line of credit)

Covenants: Some lenders may require your business to meet certain financial or operational requirements to remain in good standing.

4. Get Professional Advice

If you're not sure what type of loan is right for you or you aren't clear on what you're agreeing to in the loan agreement, ask for help. The lender itself likely has loan specialists who are available to answer questions. You could also turn to a small business resource like SCORE, which provides free help to business owners.

Taking out a business loan with long repayment terms gives you the opportunity to elevate your business, whether that’s to buy another company, purchase equipment, invest in real estate, hire employees, or invest in advertising.

Before taking out a business loan long-term, explore your options and find the ones you qualify for. Narrow down the list to those that offer the best rates and terms, and carefully read the terms and conditions. And don't be shy about asking for advice! Taking on a long-term business loan is a commitment, and you want to be sure you're making the right choices.